Customizing QuickBooks Online for a Nonprofit

This article was written by Audrey Blackburn of Blackburn Consulting.

I get asked all the time, “Can I use QuickBooks Online for a nonprofit?” My answer is always, absolutely! I have been a fan of QuickBooks for years. My love of QuickBooks started with the desktop version many years ago. Then, Intuit developed QBO and I was intrigued. I’m a techie by nature so I pick up and start using new software easily. The best part of QBO has always been that you can access it from anywhere and it’s so versatile.

I found QBO to be a good fit for nonprofit accounting. BUT, that doesn’t mean one can just start using it without a little prep and setup work. Just like QuickBooks Desktop, we need to set it up to best work for the nonprofit. So what things should we customize:

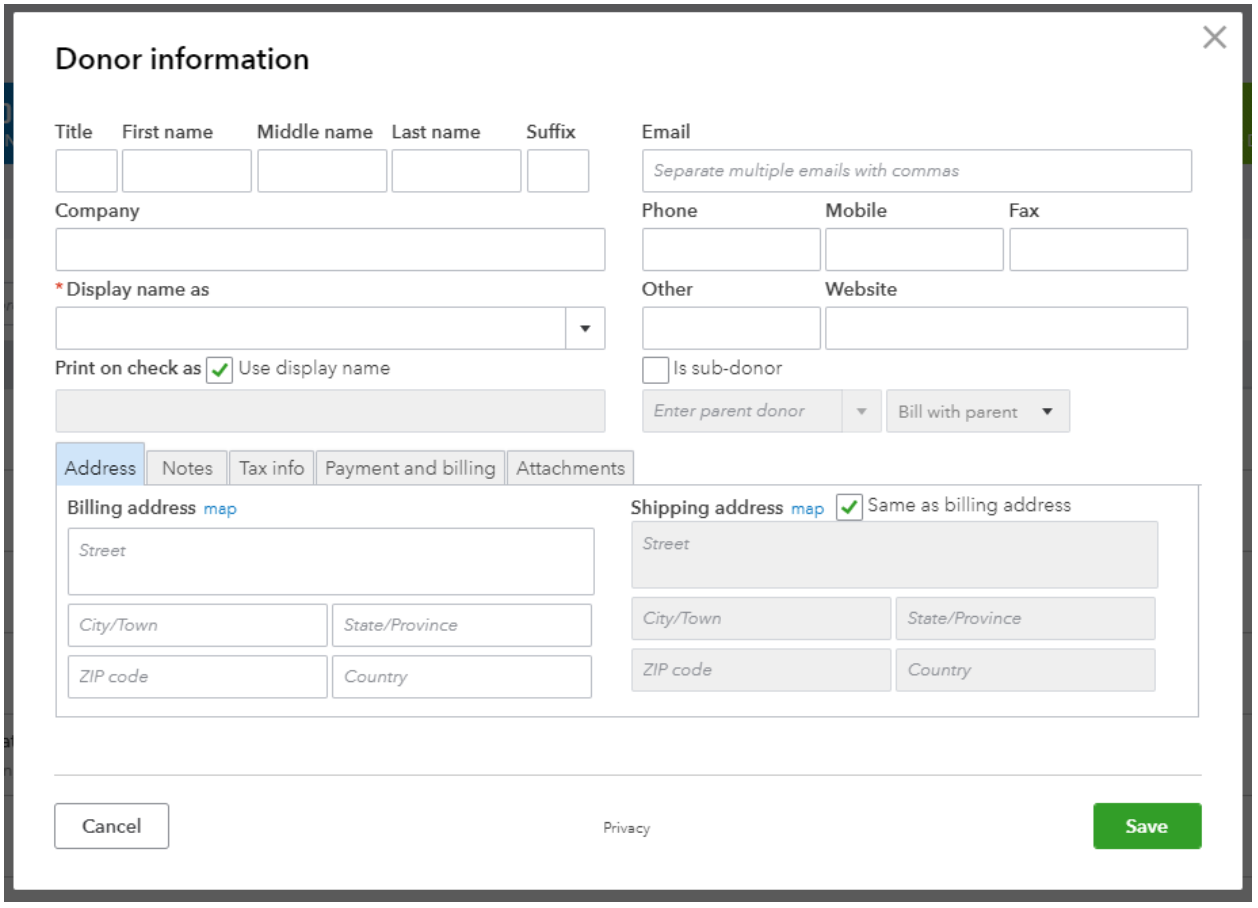

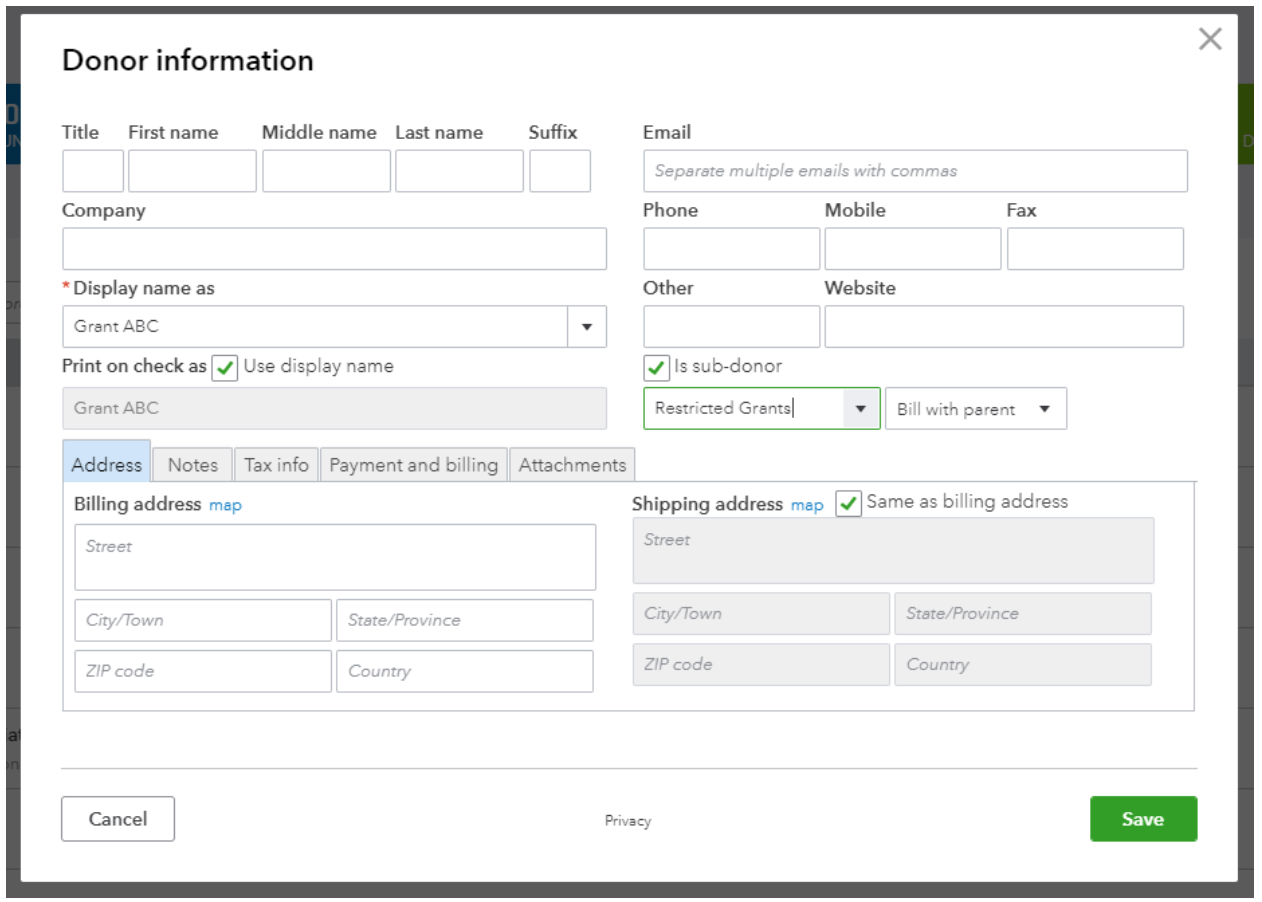

- Does the nonprofit have donors, grantors, members, etc? If the answer is yes then you will want to set them up in the traditional “customers” section of QBO. Why do this? You can track the donations made by your donors or payments made by members to the organization. At year-end, you will be able to issue a statement for your donors for their gifts. By utilizing the Customers section you will be able to get more reports about your donors or grantors.

- Set up your “products/services” list. Each one of your products or services should be directed to a corresponding income account.

- Chart of Accounts – The chart of accounts for nonprofits is always a hot topic. The old standard was to create an account for every separate program or purpose. Office Expense would turn into 5 different accounts as an Office Expense account would be needed for each program, grant or separate purpose so it could be properly tracked. That isn’t necessary if you utilize the classes.

- Use sales receipts for donations. This is the quickest and easiest way to record donations so you can produce a year-end statement.

- To track any restricted grants, set up a customer of “Restricted Grants” and add a sub-customer under Restricted Grants by the name of the actual grant you want to track. Now you can use the Customer field on income and expenses to utilize the reports. Now you will code the income and expenses for the grant to this sub-customer. You will have all your Restricted Grants in one place for easy reports.

- Set up classes – Classes are my favorite part of QBO and QB Desktop. They allow you to “class” any transaction. You can then run a P&L by class or your balance sheet by class. Classes can be anything you need them to be but for most nonprofits, you want to class things such as your programs and fundraising.

- Reports for staff and Board – Businesses look for a P&L and a Balance Sheet and a nonprofit Board is no different. These two reports provide a wealth of information. Now that you have classed all transactions you can run a P&L by Class or a Balance Sheet by Class to analyze the income and expense for your programs, your fundraising efforts or for your general operations.

With planning and proper setup, your QBO account can provide you with the information you need for your nonprofit Board and for staff to effectively manage the funds of the organization.

Share This Article!

11 Comments

Leave a Comment

You must be logged in to post a comment.

Thank you. This was awesome information and was short and succinct as well. Very helpful.

This is great and it works (thank you, by the way!), but each individual donation shows on the “Detailed P&L”. We want to see only totals in the Offerings line, but need to see all the detail in the expense categories. I love batch posting my weekly offering list and all the flexibility, but I can’t give out reports to our church council with everyone’s individual giving listed. No one seem to address this that I can find. Can you help?

Paula – Have you tried clicking on the arrows out beside the details to roll them up to a total? That works on mine to hide the individual donations but to give me “categories” based on how I have the chart of accounts broken out.

Hi Audrey, we are a non-profit that also publishes and sells books. We currently have 2 QBO companies, one for the donors/donations and the other to publish/sell books. This is causing our accounting costs to be high. If we combine into one company, is there a way for QBO to distinguish between donors and customers? When we go to print out our year-end donor tax statements, if they bought books as well will the books be included in the donations they gave?

Thanks for any help you can provide!

Becky,

I think what you need is to use income nominal accounts to separate what is a donation and what is a sale. The same agent can be a donor or a customer…by having the correct income accounts you will be able to create reports showing the total amount of donations and the total amount of sales.

If the same company is the one selling books and receiving donations, you should have just one QBO accounts. QBO allows you to record the two types of activities with its different VAT treatment, reporting…

Contact me at tomas@treesforlife.org.uk if you want to discuss that further, I am not an expert but I think I can help you out here.

The Customer Label doesn’t appear in my Canadian Non-Profit’s QBO company settings. Perhaps that’s a feature in US Quickbooks Online? Does anyone know if that’s coming down the pipe for Canadian users?

I have the same question as Lori, this is not available on the Canadian QBO. Does anyone know when this will be coming to Canada. Thanks!

As a nonprofit we track our staff time on our time sheets by Class. This way we can include staff time in our P&Ls and know the exact net profit/loss of each program is accurate. I’ve been doing this in QuickBooks Desktop by assigning multiple classes in each employee paycheck when running payroll, but we recently changed to QB online. There is no option for using multiple classes for each employee in the online version. What do you suggest? As a nonprofit, being able to track our staff time by Program, Fundraising, and Administrative is imperative.

Can you use QBO Essentials for a nonprofit or do they have to go with the Online Plus version?

I have read many articles saying to use Projects for the Programs. I am confused about how to use projects and classes. And product/services

Can someone give me a clear step by step on what to do with the following:

1. Projects – is this each program we offer (dental, esl, etc)

2. Classes – some articles say to use this for your grants, some say to use for your programs. Which?

3. Products/Services – what do we use this for?

Non-profits need to track expenses for Fundraising, Management, and Programs to comply with IRS Form 990, so shouldn’t those be the the top 3 Classes, with everything else under those as sub-classes? We are a membership non-profit. Where does Membership go? Is it part of Management, or is it a 4th top-level Class?