Practice Management

The 2020 1099 season is upon us and there have been a few changes that you need to be aware of when preparing 1099s for your clients.

Read MoreQuickBooks Online has become the best platform for my bookkeeping business. Learn how to start a virtual bookkeeping business today!

Read MoreThis marketing tech stack has allowed me to streamline all my marketing efforts on social media and with my newsletters.

Read MoreCleanups can be one of the biggest time sucks as bookkeepers – but they are key to the growth of a firm. Follow these 4 steps to save time during cleanups.

Read MoreLearn the pros and cons of using QuickBooks Wholesale Billing so you can decide if using it is the right decision for your practice.

Read MoreIf you feel behind or overwhelmed, then you need to create your own processes and workflows. This will help you find zen in your bookkeeping practice.

Read MoreUnderstanding the KPI and how it relates to the performance of a business is probably the most overlooked part of explaining KPIs.

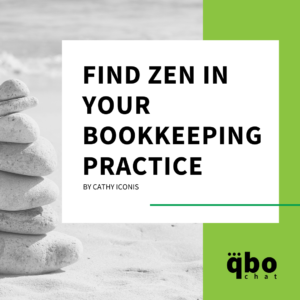

Read MoreMy biggest takeaway here is the benchmark of $100K in revenue per employee number. I believe this should be the benchmark that our industry strives for.

Read MoreRegardless of the type of business you’re operating, it’s the website that attracts leads and delivers conversions. This is especially crucial for a B2B website.

Read MoreScope creep eats away at your profits, task by task. It is important for accountants and bookkeepers to know how to protect themselves from scope creep.

Read More