How to Match a Deposit to a Customer Payment

Seeing the “Match” icon in your bank feed is always a really good feeling, but sometimes, you get stuck and have to find a way to manually match a transaction in the bank feed. In this quick How To, we are going to show you how to match a deposit to a customer payment.

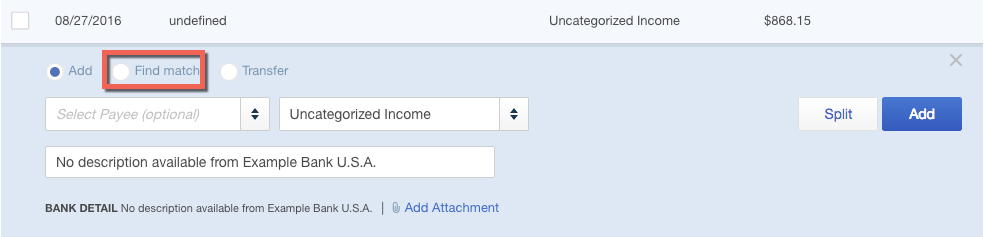

If you don’t see an immediate match, click on the transaction and then click “Find Match”.

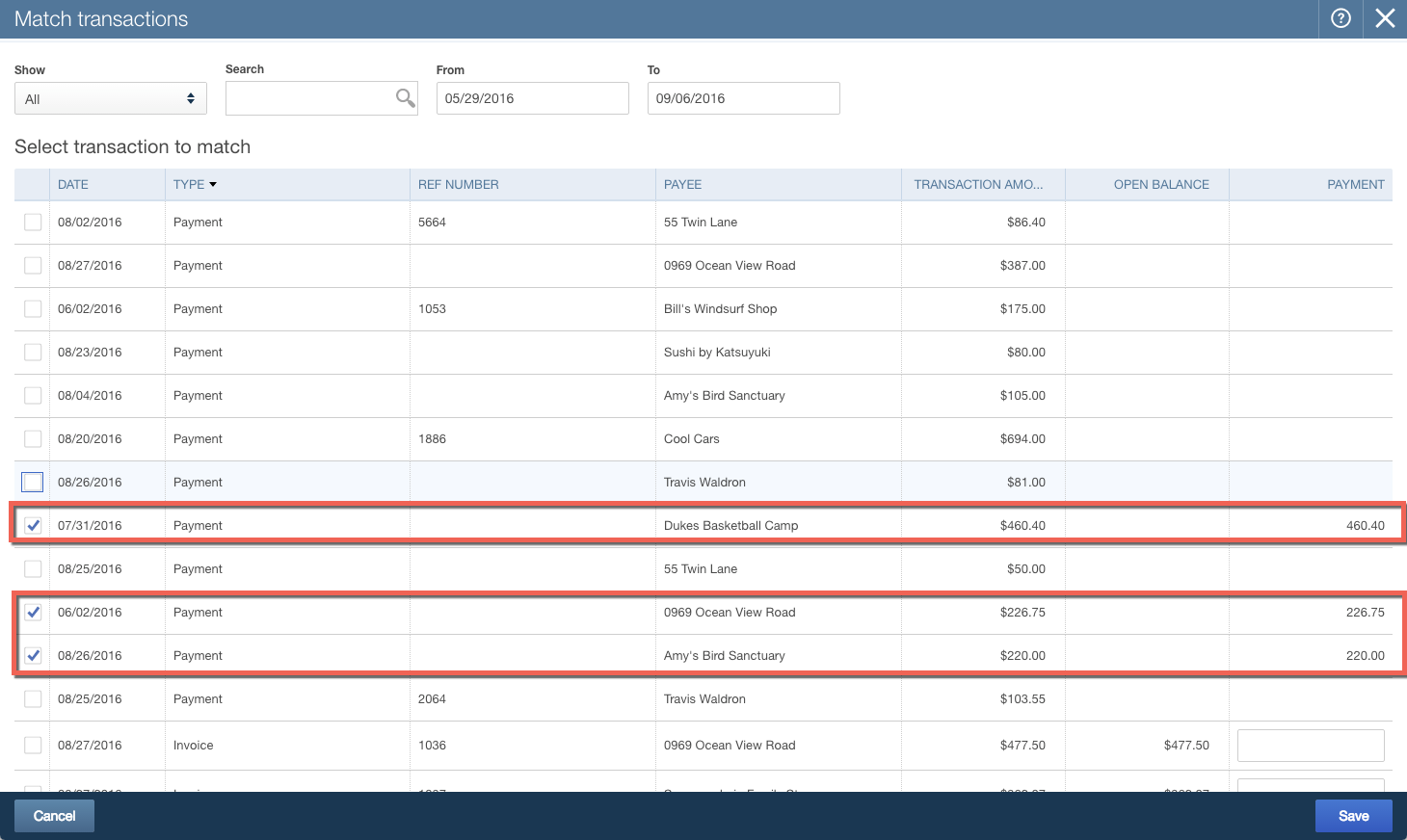

Once “Find Match” is clicked, then a screen will come down of all available invoices and payments that can be used to match up the transaction. In this example, we have selected a few of the payments from the list.

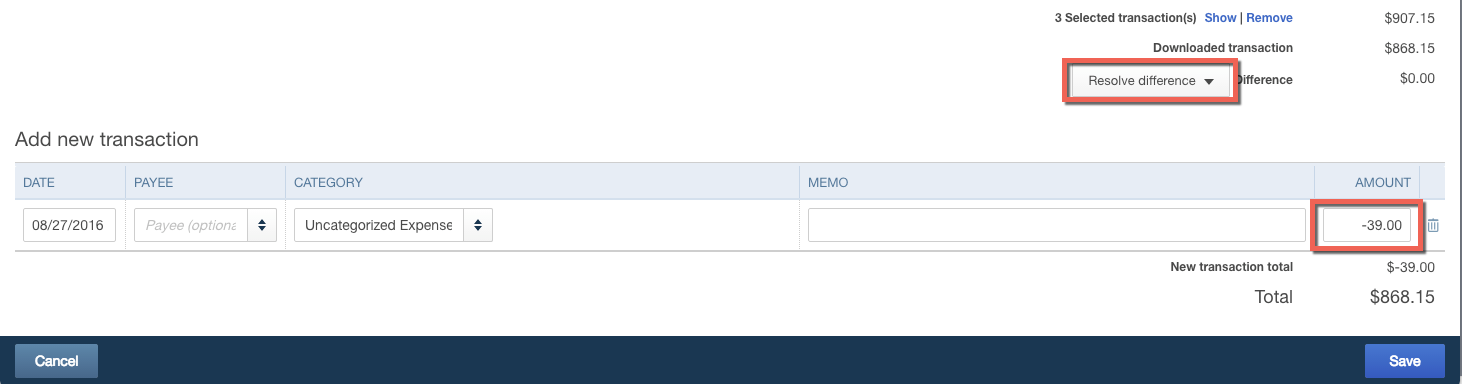

You’ll notice that the amounts selected don’t match up to the total of the deposit from the bank. At the bottom of the Match Transactions screen, you have the option to resolve the difference and you can add a new transaction to record the amount that has not been checked off. You can make this a positive or negative here. In this example, we have more payments matched than the deposit total, so we are using a negative.

If you run into an issue with finding the transactions that you want to manually match, first check your date range on the match screen. If that doesn’t work, then go back to the payment you want to include and make sure it is being recorded to undeposited funds, which is a default account provided by QuickBooks Online.